Donation Fund Usage

Welcome to the official page for UiTM Libraries’ Donation Fund Usage. This initiative by Universiti Teknologi MARA ensures transparency in managing donations received throughout the year.

All contributions—monetary and physical—are used to improve library facilities, expand digital collections, upgrade equipment, and support academic needs.

Thank you to all donors for your generosity and ongoing support.

Total donation isRM71,876.44

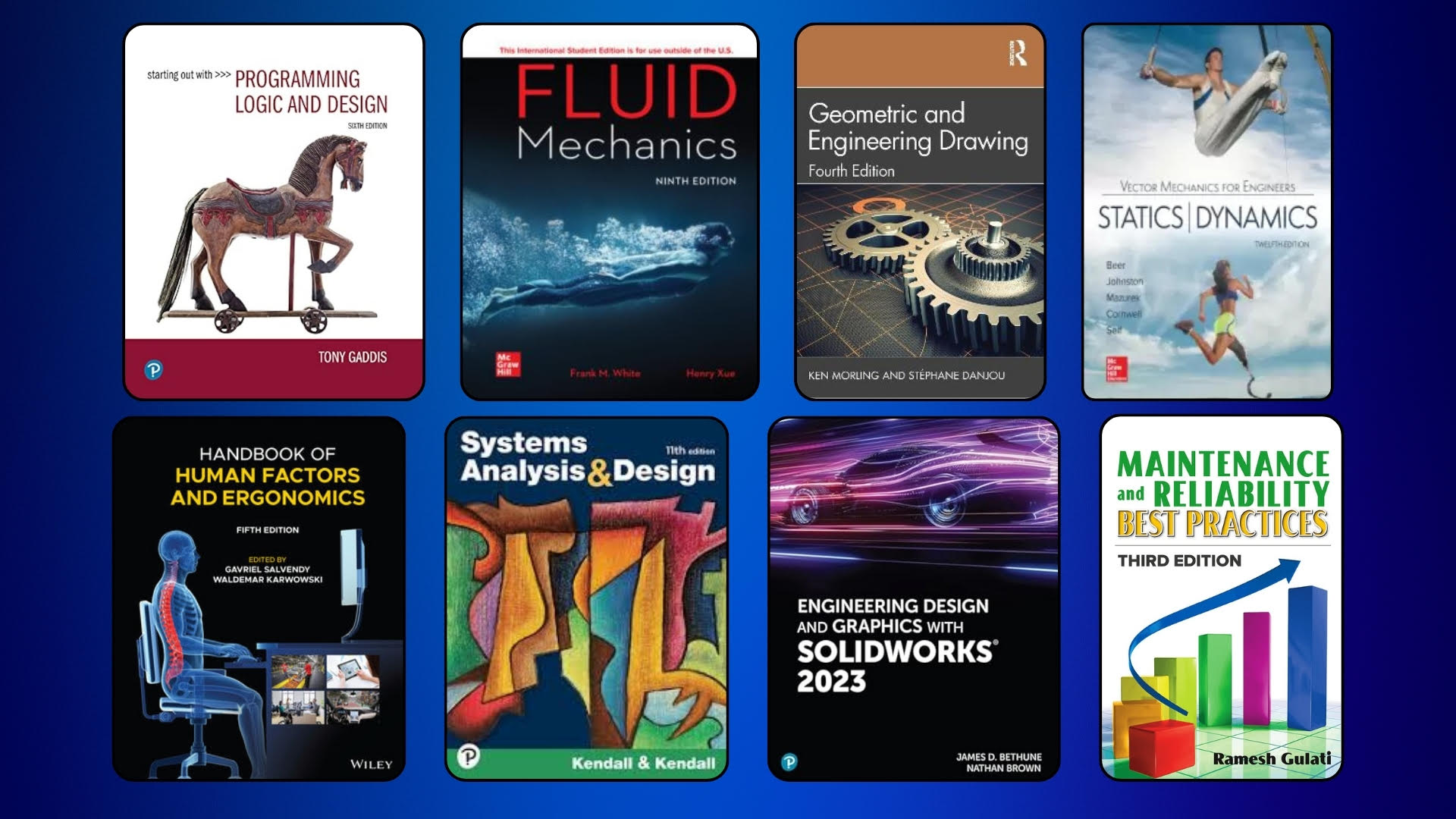

8 New eBooks Collection

RM16,302.90

Location : PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 18th November 2024

Visitor Counting Camera

RM7,000.00

Location : Kaunter PTAR 1 & Kaunter PTAR Undang-Undang

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 11th November 2024

Wooden Studio Easel

RM2,984.00

Location : Koleksi Khas Jawi

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 25th October 2024

Shure Wireless Handheld Microphone System

RM3,960.00

Location : PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 09th August 2024

3 Level Fountain Display Table

RM936.54

Location : Ruang Sofa (4th Floor), PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 25th July 2024

Pembelian dan Pemasangan Tanda Nama Koleksi Khas Jawi

RM1,380.00

Location : Koleksi Khas Jawi (4th Floor), PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 26th Jun 2024

Langganan Harvard Business Review UiTM Cawangan Johor

RM1,620.00

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 13 Jun 2024

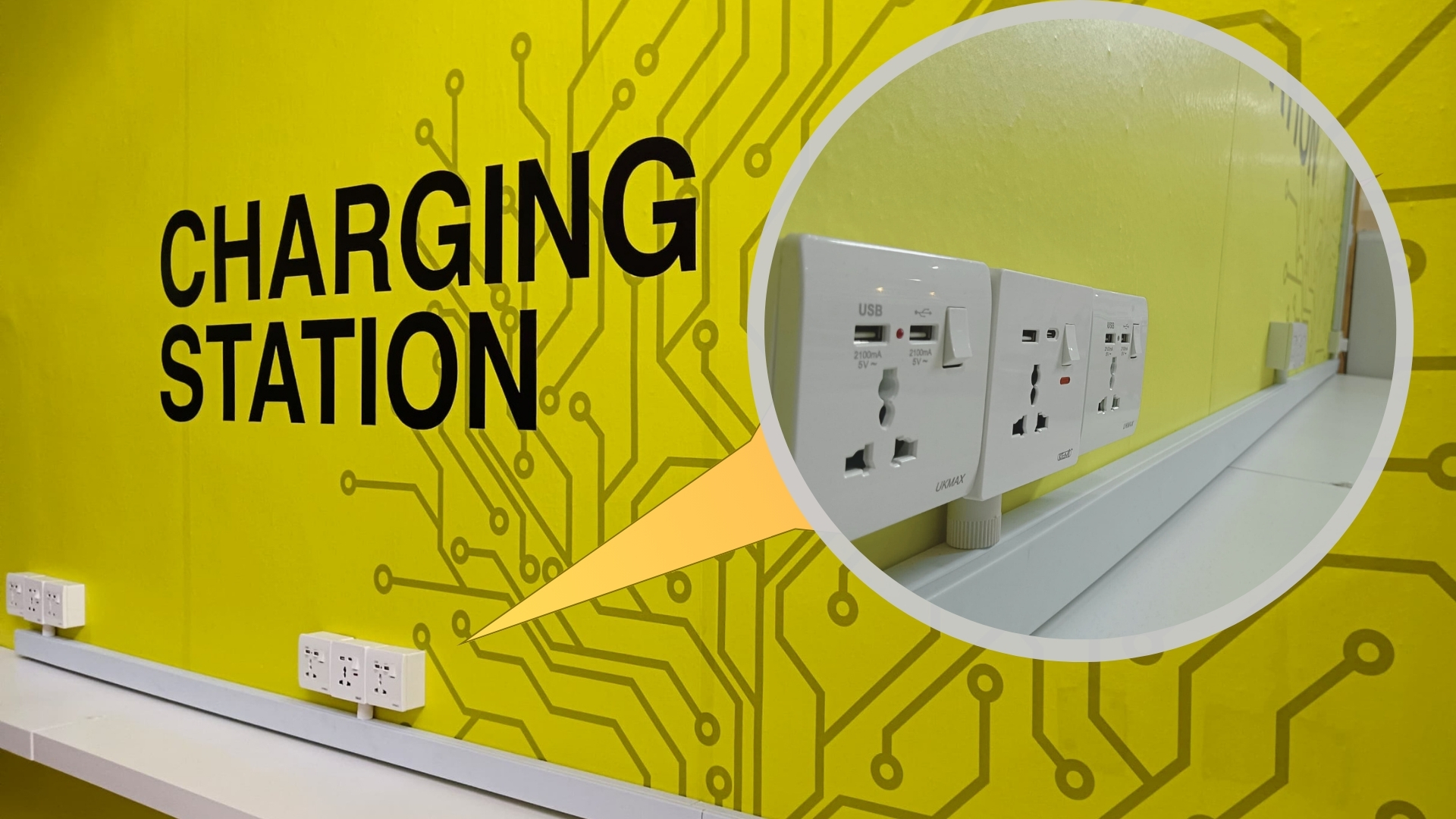

Charging Station

RM2,587.00

Location: Level 3, Perpustakaan Tun Abdul Razak, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 6 May 2024

Photo Frame for Tan Sri A. Samad Ismail Oleh Dato' Lat Face Sketch

RM1,285.00

Location: Special Collection (4th Floor), PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 29 April 2024

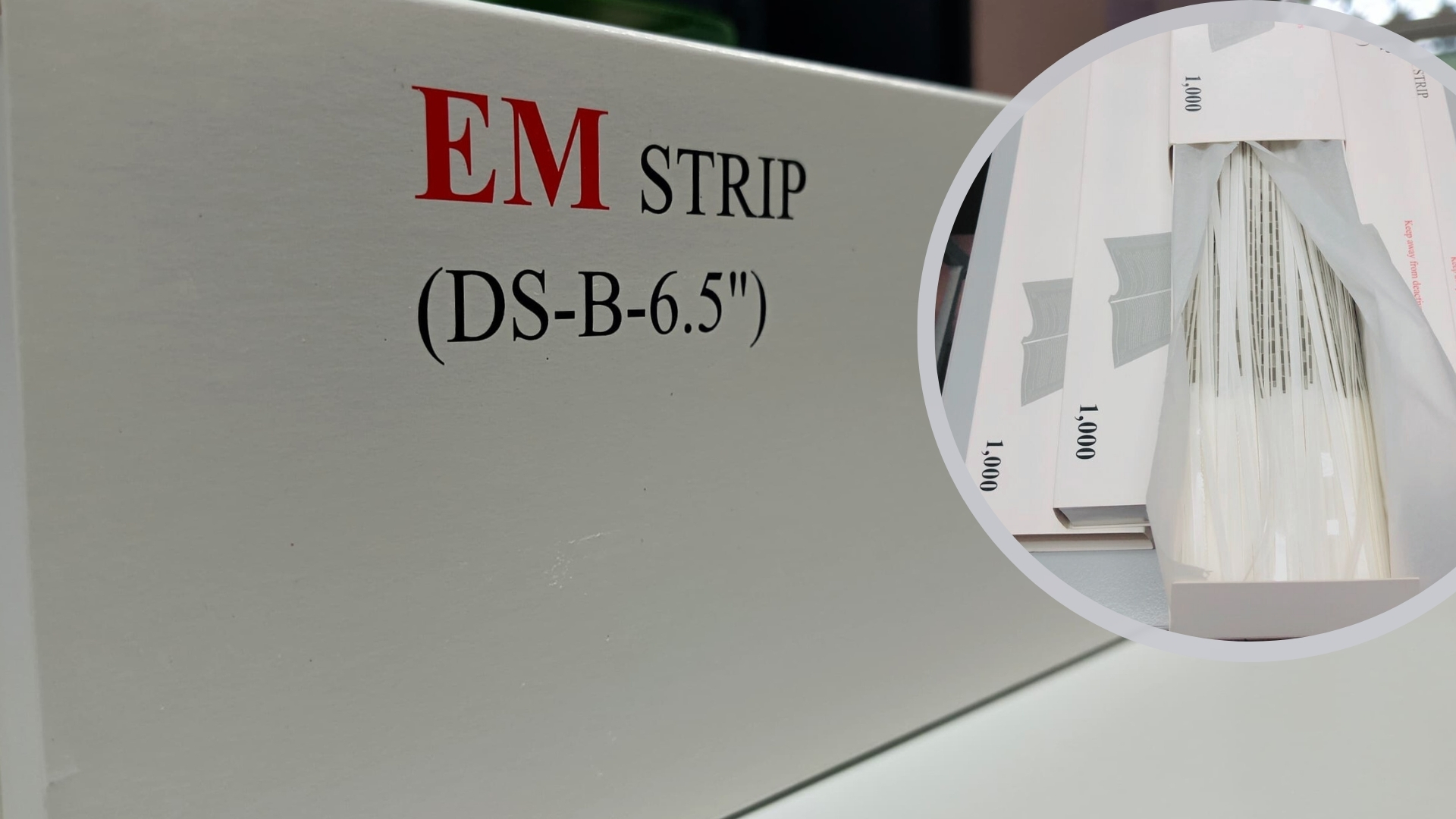

New PTAR - EM Strip

RM3,600.00

Budget Allocation : Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date : 16th April 2024

33 Titles for Jawi Collections

RM792.00

Location: Special Collection, Perpustakaan Tun Abdul Razak, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 16 March 2024

Total donation isRM42,447.44for year 2024

Library Prayer Hall

RM18,000.00

Location: 5th Floor, PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 27 March 2023

Replacement Law Library Projector Display (2 Units)

RM7,011.00

Location: Law Library (Auditorium & Meeting Room), UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 8 Disember 2023

Rostrum Stand

RM1,830.00

Location: Floor 3, Perpustakaan Tun Abdul Razak, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 6 November 2023

eResources Portal SSL Certificate

RM1,961.00

Location: https://ezaccess.libary.uitm.edu.my

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: 20 July 2023

eSport FIFA 2023 Games

RM 630.00

Location: 3rd Floor, PTAR Main Library, UiTM Shah Alam

Budget Allocation: Tabung Sumbangan Derma Wang Tunai Untuk Kemudahan Perpustakaan

Date: May 2023

Total donation isRM29,432for year 2023

Donation Of Equipment

Information on Equipment & Physical Furnishing Donations to UiTM Library

Naik Taraf

Ruang Media, PTAR 1

RM506.00

Location : Ruang Media, PTAR 1, UiTM Shah Alam

Budget Allocation: Persatuan Perpustakaan UiTM (PUTRA)

Price / Value: RM506.00

Date: January 2025

Pedestal

Koleksi Khas Jawi

RM20,000

Location : Koleksi Khas Jawi (4th Floor), PTAR Main Library, UiTM Shah Alam

Budget Allocation: Suruhanjaya Syarikat Malaysia (SSM)

Price / Value: RM20,000

Date: November 2024

Alumni Contribution

Mini Stage and Backdrop

RM3,000.00

Location: Law Library, UiTM Shah Alam

Budget Allocation: Dr. Mushin bin Ismail

Price / Value: RM3,000.00

Date: 6 November 2023

ZAWAF & PTAR’s Food Bank

RM 15,000.00

Location: PTAR 24 Hours Room

Budget Allocation: ZAWAF (Bahagian Zakat, Sedekah & Wakaf)

Price / Value: RM 15,000.00

Date: 17 Ogos 2023

Grand Total :RM38,506.00

Donation of Book

The Library of Universiti Teknologi MARA (UiTM) is deeply grateful for the generous contributions of individuals and agencies who have supported our mission to enrich knowledge and academic resources. This website serves as a formal record and recognition of those who have donated books to the library.

Through these valuable donations, we are able to expand our collection, provide wider access to quality resources, and foster a culture of reading and learning within the university community. We acknowledge and appreciate the generosity of our donors, whose support plays a vital role in advancing education and scholarship.

| # | Donator | Date | Num of Book | Price (RM) |

|---|

Library Book Donation

As part of its commitment to knowledge sharing and community engagement, the Universiti Teknologi MARA (UiTM) Library has initiated a book donation program aimed at supporting educational institutions, organizations, and individuals in need of academic resources. This website serves as a comprehensive record of the various agencies and personnel who have benefited from this initiative.

Here, you will find an updated list of recipients who have received book donations from the UiTM Library, reflecting our ongoing efforts to promote literacy, support lifelong learning, and extend the reach of our educational materials beyond campus boundaries. Whether you're a stakeholder, partner, or member of the public, we invite you to explore this repository and witness how collective generosity contributes to the broader goal of educational empowerment.

- View all

- Library Book Donation

-

PTAR UiTM Sumbang 40…

Sebagai usaha berterusan memperkukuh budaya ilmu dan literasi di peringkat sekolah rendah, Perpustakaan Tun Abdul…

Thursday July 24

In Library Book Donation -

Sumbangan Buku dan Kolaborasi…

Perpustakaan Tun Abdul Razak (PTAR), Universiti Teknologi MARA (UiTM) Shah Alam terus memperluas jaringan kolaborasi…

Friday May 30

In Library Book Donation -

PTAR Sumbang 78 Naskhah…

Sebagai sebahagian daripada inisiatif tanggungjawab sosial dan pengembangan ilmu di peringkat komuniti, Perpustakaan Tun Abdul…

Friday April 18

In Library Book Donation -

PTAR Sumbang 370 Naskhah…

Sebagai sebahagian daripada inisiatif memperluas jaringan ilmu dan menyokong pembangunan literasi di peringkat sekolah, Perpustakaan…

Friday April 18

In Library Book Donation -

PTAR Sumbang 233 Naskhah…

Sebagai usaha memperkukuh peranan perpustakaan universiti dalam pembangunan ilmu dan khazanah Islam, Perpustakaan Tun Abdul…

Friday April 18

In Library Book Donation -

PTAR Sumbang 216 Naskhah…

Perpustakaan Tun Abdul Razak (PTAR) UiTM Shah Alam meneruskan komitmennya dalam memperkasa jaringan ilmu dan…

Monday October 28

In Library Book Donation -

PTAR Sumbang 157 Naskhah…

Shah Alam, 14–18 September 2024 Perpustakaan Tun Abdul Razak (PTAR) UiTM Shah Alam terus komited…

Saturday September 14

In Library Book Donation

PTAR UiTM Sumbang 40 Buah Buku Bernilai RM660.00 kepada SK Taman Sri Muda, Shah Alam

Sebagai usaha berterusan memperkukuh budaya ilmu dan literasi di peringkat sekolah rendah, Perpus

.jpeg)

Sumbangan Buku dan Kolaborasi Pendigitalan Manuskrip Bersama Madrasah al-Ahmadiah al-Islamiah, Narathiwat

Perpustakaan Tun Abdul Razak (PTAR), Universiti Teknologi MARA (UiTM) Shah Alam terus memperluas

PTAR Sumbang 78 Naskhah Buku Bernilai RM2,186.53 kepada Perpustakaan Komuniti Al-Islah, Selangor

Sebagai sebahagian daripada inisiatif tanggungjawab sosial dan pengembangan ilmu di peringkat kom

PTAR Sumbang 370 Naskhah Buku Bernilai RM10,437.96 kepada SMK Seri Duyong, Melaka

Sebagai sebahagian daripada inisiatif memperluas jaringan ilmu dan menyokong pembangunan literasi

.jpeg)

PTAR Sumbang 233 Naskhah Kitab Bernilai RM18,138.00 kepada Perpustakaan Madrasah Nur Muhammad, Kelantan

Sebagai usaha memperkukuh peranan perpustakaan universiti dalam pembangunan ilmu dan khazanah Isl

PTAR Sumbang 216 Naskhah Buku Bernilai RM27,380.46 Kepada Perpustakaan Goon International College

Perpustakaan Tun Abdul Razak (PTAR) UiTM Shah Alam meneruskan komitmennya dalam memperkasa jaring

PTAR Sumbang 157 Naskhah Buku Sempena Program ASEAN Volunteerism Project: A Nurture Nation

Shah Alam, 14–18 September 2024

Perpustakaan Tun Abdul Razak (PTAR) UiTM Shah Alam teru

Donation / Sadaqah

The Income Tax Act 1967's subsection 44 (8), which addresses monetary gifts for library facilities, provides the Malaysian Inland Revenue Board (IRB) with an income tax exemption that guides the collection of financial donations. Cash donations cannot exceed RM20,000.00, and donors are exempt from income tax under the aforementioned laws.

Nevertheless, donors who operate a business and are qualified for deductions under ITA paragraph 34 (6) (g) are ineligible for deductions under ITA subsection 44 (8).

The Universiti Teknologi MARA Library has announced a plan to raise money for the university by asking visitors and residents of UiTM to donate cash for library amenities. This financial contribution aims to generate funds and create new opportunities for the general public, individuals, alumni, and UiTM members to contribute to the advancement of knowledge in the fields of learning, teaching, and research, thereby fostering the development of future generations of great professionals.

Salary Deduction

For UiTM Staff only

Step to create a deduction.

- Login to UiTM FinePortal using your Gmail account.

- Go to the menu FinePayroll > Permohonan > Potongan Gaji

- Click Permohonan Icon

- Select Sumbangan Kem. Perpustakaan for Jenis Portongan and fill up other information.

- Click Hantar

Giving@UiTM

UiTM Members and communities.

Step to donate.

- Browse to Sumbangan Portal in MyKM.

- Fill up the form on the page.

- Click the Submit button.

You'll now be directed to the page UiTMPay with the previous information. - Click the PAY button.

- Complete the transaction either using FPX, Kiple, or Visa

Objectives

This cash donation's primary goal is:

1.To upgrade and add new library facilities.

2.To provide funds for the library's acquisition of books, furniture, chairs, shelving, and other items.

3.To generate university revenue.

Benefits

1.Tax Exemption:

Contributors are eligible for Income Tax Exemption under subsection 44 (8) of the Income Tax Act 1967 regarding Cash Prizes for Library Facilities for cash donations not exceeding RM20,000.00.

2.External Library Membership at UiTM (Non-UiTM Members) according to categories that refer to approval as external library membership. Please refer to https://library.uitm.edu.my/membership/external-membership

Donation

The UiTM Library has received numerous generous donations that have significantly enhanced its resources and services. These contributions, ranging from books and technology to financial support, have played a crucial role in expanding the library’s collection and improving the academic experience for students and staff. Below is a list of key donations that have enriched the UiTM Library's offerings.

PTAR ingin mengucapkan ribuan terima kasih kepada para penyumbang yang telah menyumbang kepada kemudahan perpustakaan. Hanya Allah SWT yang dapat membalas jasa baik para penyumbang dan sentiasa dikurniakan rezeki yang tidak pernah putus.